Deductibles as they apply to construction works

Over a decade ago, while in public office, I was part of a team working on a portfolio of large infrastructure projects funded by the World Bank and the German Development Agency (KFW). Our assignment was to move the numerous projects in the portfolio from concepts to physical infrastructure and then hand over this infrastructure to colleagues in a different department to operate. A month before announcing the construction works tender for one of the projects, I was reviewing the contract conditions and landed on what I was convinced at the time was unfamiliar territory, i.e., Insurance as it applies to construction works. Therein, I appreciated the meaning of the term deductibles, a lot better.

By then, I was paying an annual premium of Uganda Shillings 1,000,000 for my motor vehicle that was valued at Uganda Shillings 25,000,000. The policy premium was 4% of the motor vehicle value. The deductible on this motor vehicle insurance policy was 10% of the motor vehicle value, i.e., Uganda Shillings 2,500,000 – meaning, for instance, in the event of a complete write-off arising from a fatal accident (hoping I came out alive), the insurer would only pay 90% of the motor vehicle value, i.e., Uganda Shillings 22,500,000, leaving me with the responsibility to part-fund the motor vehicle replacement cost to the tune of Uganda Shillings 2,500,000 (the deductible).

Deductibles are a cornerstone in the insurance business. They are a mode of risk-sharing that checks the inherent levels of negligence in an insured that may precipitate a claim. Via a deductible, an insurer says, “We can cover your risk but only up to 90% of the risk, and you shall cover 10% of the same risk”.

A word of wisdom: Always ensure that the insurance coverage (90% of the motor vehicle value in this case) can fully cover your asset (risk) without you having to top up the 10%.

When preparing bidding (tender) documents for construction works, the Employer usually indicates the deductibles for specific insurances that a party (usually the Contractor) shall take out. In practice, the permitted deductibles allowed in the applicable insurance policy should not exceed the amounts stated in the bidding documents and, if not stated, the amounts agreed with the Employer. So, the insuring party (normally the Contractors) should not take out any insurance with a deductible greater than the amount stated in the bidding documents.

What is the catch? Contractors will likely prefer a higher deductible because they will pay less premium. In comparison, an Employer will usually prefer a lower deductible to maximise the financial protection offered by the insurance coverage. To absorb these deductibles, Contractors self-insure themselves by factoring in the total cost of these deductibles in their unit rates – perhaps under specific bills in the general items or wherever they please. So, either way, the contractor “wins.”

The insuring party is normally required to take out the related insurances before the commencement date or before physical works commence. So, if it were up to me, I would (before submitting my bid) ask my quantity surveyor to skilfully spread the total cost of these deductibles in bill items that are usually expensed early on in the project cycle – expecting a ‘repayment’ within the first three to six months of implementation.

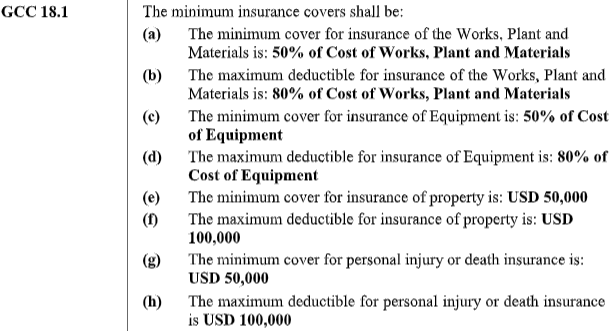

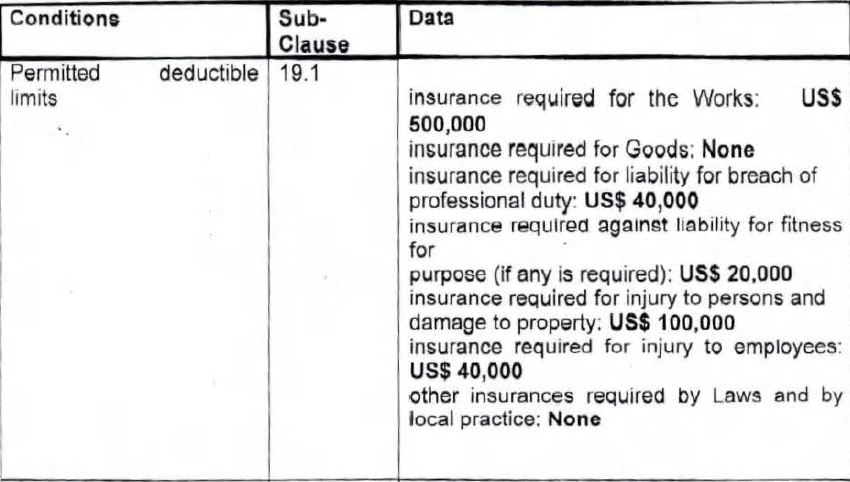

With this theory out of the way, I can share two real-life scenarios I experienced on drafting deductible provisions. The first (refer to Figure 1 scenario A), I extracted from bidding documents prepared by an Employer for a small solar water project, and the second (refer to Figure 2 scenario B), I obtained from the bidding documents prepared for a 100-kilometer design and build murram road project.

Figure 1: Scenario A – An extract of the deductible provisions for a solar water project

Figure 2: Scenario B – An extract of the deductible provisions for a Murram Road project

Traditionally, the insuring party normally takes out insurance policies for the Works, Goods, Professional indemnity (where design is part of the scope of work), damage to third-party persons and property, and injury to employees (of the insuring party), and perhaps any other insurances required by local practice or under the governing law of the contract.

In Figure 1, scenario A, four of the eight insurance policies, i.e., (a), (b), (c), and (d), did not state the deductible as a monetary figure. Instead, the author(s) of this provision indicated the deductibles as a percentage of the Contractor’s Equipment, Works, Plant, and Materials – leaving it up to the Contractors to decide on (i) the value of the Equipment, Works, Plant, and Materials, and (ii) the corresponding deductible. On numerous counts, this approach of stating the deductibles places the Employer in a precarious position.

Additionally, I found the phrase maximum or minimum, used in the contract provision, to be disadvantageous because it gave the insuring party the latitude to determine the value of the deductible and the corresponding value of the insurance cover for the insured risk. Recall from paragraph six above that:

Contractors will likely prefer a higher deductible because they will pay less premium. In comparison, an Employer will usually prefer a lower deductible to maximise the financial protection offered by the insurance coverage.

Conversely, I found the presentation of the deductibles in scenario B to be better than those in scenario A. My only reservation was whether (given the type and magnitude of the murram road project) the author(s) in scenario B had undertaken a thorough risk assessment to arrive at the deductibles for each insurance policy.

Experience has taught me the following.

- When it comes to computing the deductibles to insert in the bidding documents, there is a lot of copy and paste going on in the construction sector – especially on construction projects within similar sectors, yet projects have varying risks. This leaves many Employers exposed, and they do not even know about it, but the contractors and insurance companies (the cutthroat business people) are fully aware.

- Reviewers of bidding documents commonly focus on their areas of strength. A quantity surveyor will typically concentrate on bills of quantities (BOQ), a procurement person will focus on the Instructions to Bidders (ITB) and the evaluation and qualification criteria, and designers will focus on drawings and specifications or Employer’s requirements. Insurance, as it relates to construction works, has few competent people.

- Get help if you do not understand certain things. It may cost you nothing to admit ignorance.

Back to my motor vehicle. I’ve since stopped paying my annual premium for the motor vehicle after enriching the cutthroat business people for over a decade. But that’s purely out of choice. Do not apply the same “wisdom” to a public infrastructure project.